Diversification: Renewed Case for the Inclusion of Hedge Funds

-

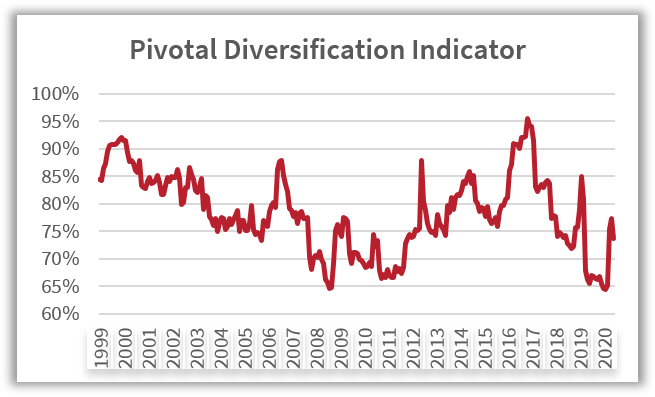

The Pivotal Diversification Indicator, which combines proprietary measurements of both the likeness of 2,000+ institutional quality hedge funds and the underlying risk-factors they trade, rose back to its 10-year average after falling to an all time low this past February (using data going back to 1998).

-

Falling correlations bode well for hedge funds generally as they can capitalize on unique risks, leading to unique return streams, a complement to any diversified portfolio.

-

In discussion with our allocator clients, we are already seeing this healthy environment for hedge funds leading to interest in increasing their hedge fund portfolios.

-

As further evidence to this positive hedge fund environment, 38 out of the 40 strategies we track have generated positive alpha relative to the S&P 500 over the last year, including all broader strategies on the alpha leaderboard.

-

Notably, this overwhelmingly consistent alpha generation occurred during a rolling 12-month period where the S&P 500 returned 40.3% while exhibiting a Sharpe Ratio of 2.75.

For additional insight contact inquiry@pivotalpath.com